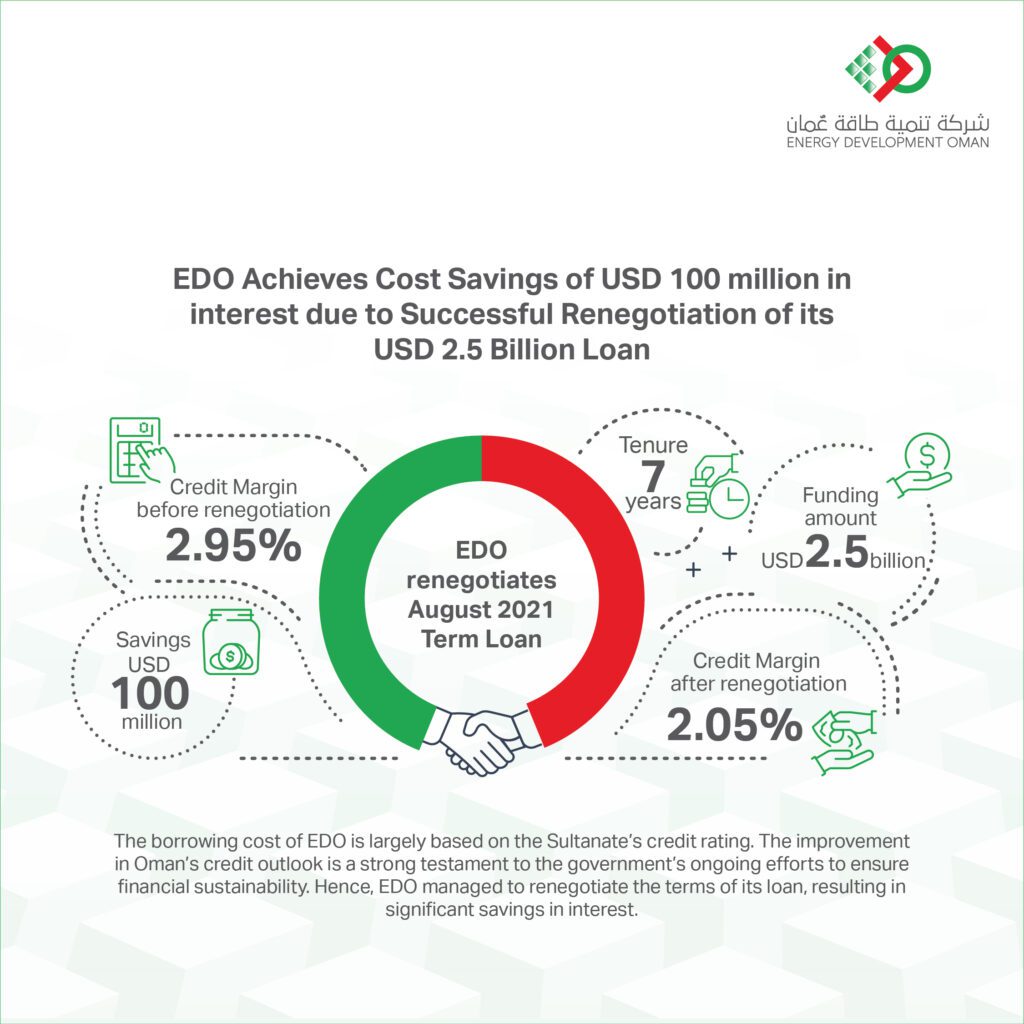

Energy Development Oman (EDO), a 100% government-owned entity, has successfully renegotiated the terms of its USD 2.5 billion loan, resulting in cost savings of USD 100 million in interest.

The move sets a new benchmark for EDO and represents a significant saving for the company and the Sultanate of Oman. The exercise is part of a broader initiative aimed at reducing interest costs across government-related entities in Oman in line with the government’s objectives to achieve financial sustainability.

The borrowing cost of EDO is largely based on the credit rating of the Sultanate of Oman. In 2022, the rise in oil and gas prices along with the government’s continued efforts to ensure financial sustainability led to two ratings agencies, Fitch Ratings and Standard and Poor’s (S&P), raising their rating assessments. This improvement in the credit outlook attracted more investors to the Sultanate.

S&P Global Ratings has revised its outlook on Oman to positive from stable while affirming its ‘BB/B’ long- and short-term foreign and local currency sovereign credit ratings. According to the report, Oman’s government is repairing its balance sheet, with debt repayments and strong nominal GDP growth.

Mazin bin Rashid Al Lamki, the CEO of EDO, commented on the country’s improved credit rating, saying, “The latest credit rating upgrade by S&P Global Ratings is a strong testament to the government’s prudent fiscal policies and ongoing economic reform efforts. As a result of this upgrade, we expect to see increased investor confidence and interest in Oman, which will, in turn, support economic growth. For EDO, this means that we will have access to more favourable borrowing terms and is a positive step towards achieving our goal of supporting Oman’s long-term development.”

Taking advantage of the country’s improved credit profile, EDO proactively sought to renegotiate its seven-year USD 2.5 billion loan, issued in August 2021 and signed initially at a fixed credit margin of 2.95%. While EDO could have taken a brand-new loan to repay the 2021 facility, the cheaper option was to ask the bank group to voluntarily amend the existing loan to a lower margin. The company worked closely with the Debt Management Office (DMO) of the Ministry of Finance to set the margin at 2.05%.

“We are pleased with the successful outcome of the loan renegotiation. The repricing of the loan is a fantastic result and highlights the company’s ability to identify market opportunities and minimise risks,” said Mazin Al Lamki. “The move sets a new benchmark for EDO and is expected to impact the company’s future operations significantly. We are grateful for the support of our Board of Director, the Debt Management Office, and our colleagues in EDO who made this possible.”